Jump to previous Scheer columns on the Enron scandal

FINALLY, after four years of legal maneuvering, the trial of Enron top dogs Ken Lay and Jeffrey Skilling opens a new window on the outrageous practices of our modern-day robber barons. But it is depressing that the politicians who benefited from Lay’s largesse, and who changed the law enabling Enron’s chicanery, are going unpunished and even uncriticized.

Indeed, the larger crime, in any proper moral dimension of that word, was committed in the rewriting of the law on corporate regulation to permit Enron’s very existence as a humongous stock market swindler. There simply would be no Enron story were it not for the deregulation of the energy market ushered in by Republican politicians, as Lay himself acknowledged freely in a 2000 interview when asked to explain the “common thread” in Enron’s business model.

“I think the common elements first are that, basically, we are entering markets or in markets that are deregulating or have recently deregulated, and so they have become competitive, moving from monopoly franchise-type businesses to competitive, market-oriented businesses,” said Lay.

Enron’s domination of those deregulated markets was made possible, to a large degree, through the work of the powerful Washington couple, Phil Gramm, then-Republican senator from Texas, and his wife Wendy, then-chair of the Commodities Futures Trading Commission (CFTC). Perhaps predictably, neither Gramm has been charged with any crimes in connection with the Enron scandal, and both are barely mentioned in the two leading books on the scandal by New York Times business writers. But their antics, well-documented by the leading public-interest watchdog group Public Citizen, are the key to understanding the Enron debacle.

Back in 1993, when Enron was an upstart energy trader and Wendy Gramm occupied the position of chair of the CFTC, she granted the company, the biggest contributor to her husband’s political campaigns, a very valuable ruling exempting its trading in futures contracts from federal government regulation.

She resigned her position six days later, not surprising given that she was a political appointee and Bill Clinton had just defeated her boss, the first President Bush. Five weeks after her resignation, she was appointed to Enron’s board of directors, where she served on the delinquent audit committee until the collapse of the company.

There was perfect quid pro quo symmetry to Wendy Gramm’s lucrative career: Bush appoints her to a government position where she secures Enron’s profit margin; Lay, a close friend and political contributor to Bush, then takes care of her nicely once she leaves her government post.

Although she holds a Ph.D. in economics and often is cited as an expert on the deregulation policies she so ardently champions, Gramm insists that while serving on the audit committee she was ignorant of the corporation’s accounting machinations. Despite her myopia, or because of it, she was rewarded with more than $1 million in compensation.

A similar claim of ignorance of Enron’s shenanigans is the defense of her husband, who received $260,000 in campaign contributions from Enron before he pushed through legislation exempting companies like Enron from energy trading regulation.

“This act,” Public Citizen noted, “allowed Enron to operate an unregulated power auction — EnronOnline — that quickly gained control over a significant share of California’s electricity and natural gas market.”

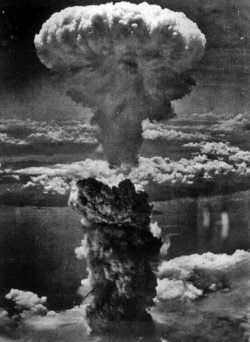

The gaming of the California market, documented in grotesque detail in the e-mails of Enron traders, led to stalled elevators, hospitals without power and an enormous debt inflicted on the state’s taxpayers. It was only after the uproar over California’s rolling blackouts, which Enron helped engineer, that the Federal Energy Regulatory Commission finally re-imposed regulatory control — and thereby began the ultimate unraveling of Enron’s massive pyramid of fraud.

Because the second President Bush effectively stalled a more timely response by the FERC, Enron’s demise came too late to prevent California from losing its shirt in its desperate attempt to keep the lights on. The state was forced to hurriedly sign price-gouging long-term energy contracts in order to prevent more damage.

And Bush, even at that late date, still attempted to save Enron by reversing the policy of the Clinton administration aimed at closing off foreign-tax shelters of the type favored by the company’s duplicitous executives. Bush, who received $1.14 million in campaign contributions from Enron, according to Public Citizen, couldn’t understand why the company should not be allowed to have 874 subsidiaries located in offshore tax and bank havens.

As the trial reveals just how fraudulent those offshore Enron operations apparently were, keep in mind that this President Bush was most loathe to clear out those refuges of corporate pirates.

LINK

No comments:

Post a Comment