| VIEW: Iran’s real crime? —S Imam If Iran starts its own euro-denominated oil bourse and it takes off, the US dollar — already an ailing currency due to huge deficits in the US economy — will be marginalised as the global currency. Iran is taking a calculated risk

Iran proposes to set up by March 2006 an “oil/energy bourse” for trading based on the euro, rather than the US dollar. While it may seem innocuous, this represents a grave threat to the continued global hegemony of the United States and as such its ailing economy.

Oil trade based on the US dollar gained strength when Saudi Arabia agreed to join it after the US government’s decision to de-link its currency from gold. Since the 1970s, the OPEC countries have agreed to sell oil for US dollars only. This means that every country needing to import oil must first acquire enough US dollars. Today most of the oil trading takes place on the New York Mercantile Exchange (NYMEX) and the London-based International Petroleum Exchange (IPE). The net result is global hegemony of the US dollar.

However, if Iran starts its own euro-denominated oil bourse and it takes off, the US dollar — already an ailing currency due to huge deficits in the US economy — will be marginalised as the global currency.

Iran is taking a calculated risk and hoping that enough countries have an interest in a “petro-euro” market to contain American aggression. Many central banks around the world are already quietly shedding their dollar reserves, nervous that America’s economic fundamentals ($500 billion federal deficit, $700 billion current accounts deficit, $4.5 trillion federal debt, record business and personal debts, little savings) cannot be sustained for long, and hoping to insulate themselves from what they see as an inevitable recession. Since 2000 the US dollar has declined by a third against the euro, despite the petrodollar arrangement.

Europe is eager, meanwhile, to enjoy more of the “virtuous circle” that results from supplying a major reserve currency: a ready market for its currency and guaranteed reinvestment as euro-holders plant their money in European markets. President Vladimir Putin of Russia, too, has also expressed interest in switching from dollars to euros. Russia would benefit from getting paid for its exports in a stronger currency. This would also represent a political victory over America after 15 years of watching its (Russia’s) clients and assets in the oil-rich Caspian region co-opted by the American expansion.

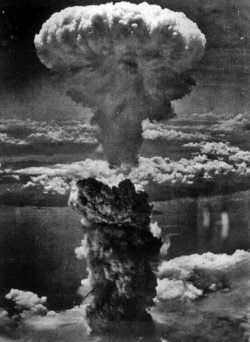

It is easy to understand therefore why Iran’s nuclear programme has become the cornerstone of the US foreign policy. One of Saddam Hussein’s crimes that infuriated US and precipitated the invasion of Iraq, some analysts believe, was selling oil for euro. But Iran’s crime is even greater. It plans to launch a euro-based bourse. So how can Iran be spared?

Luckily for Iran, and unfortunately for USA, American forces in the region (deployed in the Middle East and Afghanistan) are completely bogged down. In these circumstances, an invasion of Iran can become a disastrous undertaking for US. The US strategy for now, therefore, is to stop Iran from exporting oil by securing UN Security Council resolution imposing economic sanctions on the country under the pretext of its alleged nuclear weapons programme. So far Iran seems to have played its cards well. Its only fear is that another 9/11 like incident could hand US the licence to kill anyone!

This is the only factor beyond Iran’s control. Otherwise even the threat of an attack on Iran’s nuclear installations by Israeli and/or US air force(s) cannot reverse the situation. Let’s see how far the US can push the IAEA board to refer Iran’s case to UN Security Council. The regular meeting of the IAEA board meeting is scheduled for February 2.

S Imam is a London-based journalist from Pakistan |

No comments:

Post a Comment